-

Nutrivend selects Forterro’s Orderwise to support online expansion and streamline operations - April 11, 2025

-

ARROWXL LAUNCHES AMBITIOUS ZERO WASTE ROADMAP - April 8, 2025

-

THE BCMPA’S NEW CAMPAIGN DRIVES OUTSOURCING SUCCESS IN Q1 - April 7, 2025

-

BLACKOUT TECHNOLOGIES TARGETS TELEMATICS-INTEGRATED MOBILE DEVICE BLOCKING TO COMBAT SMARTPHONE DISTRACTION - April 1, 2025

-

Sparck Technologies awarded Royal designation - March 27, 2025

-

OpenADR Alliance announces first OpenADR 3.0 certified products with EVoke Systems, E.ON Energy and Universal Devices - March 25, 2025

-

Growing fulfilment and contract packer appoints new Managing Director - March 25, 2025

-

When is it time to invest in a WMS? Understanding the key trigger points - March 25, 2025

-

eCapital helps Vantage Recruitment on its journey to financial success - March 24, 2025

-

Hugo Beck Celebrates 70 Years of Packaging Innovation with Open House Events - March 20, 2025

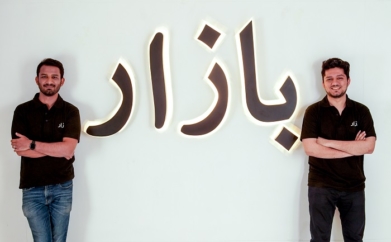

Bazaar, Pakistan’s leading B2B e-commerce and fintech platform has raised $70M in a Series B financing led by Dragoneer Investment Group and Tiger Global Management. Through its expanding footprint of digital products and last-mile infrastructure, Bazaar provides procurement, fulfilment, operating software, digital lending, and supply chain products to merchants and suppliers in Pakistan. This investment, which comes just 6 months after its historic Series A, takes Bazaar’s total institutional funding to over $100M, establishing it as one of the most well-capitalized startups in the country’s rapidly growing tech ecosystem.

Existing investors, including Indus Valley Capital, Defy Partners, Acrew Capital, Wavemaker Partners, B&Y Venture Partners and Zayn Capital also participated in the round.

“We are thrilled to support Bazaar’s vision of building an end-to-end commerce and fintech platform for millions of unbanked and offline merchants in Pakistan”, said Christian Jensen, Partner at Dragoneer Investment Group. “Bazaar’s pace of geographic expansion and new product development is a testament to the rare talent and culture Hamza and Saad have cultivated at Bazaar.”

Bazaar’s mission is to build an operating system for traditional retail in Pakistan. This retail economy, worth over $170B, is primarily offline and mostly served through 5 million SMEs across the country. This merchant base, which is the lifeline of Pakistan’s economy, also lacks access to formal financial services in a country that hosts the world’s third largest unbanked population. At the same time, Pakistan is undergoing a massive digital penetration wave driven by widespread availability of affordable smartphones and some of the lowest mobile broadband costs in the world. Bazaar aims to capitalize on these fundamentals by building an integrated platform of B2B offerings that can aggregate, digitize, and finance the country’s fragmented retail landscape.

Bazaar has been growing at an incredible pace since starting out less than two years ago. Its B2B e-commerce marketplace is now servicing 21 towns and cities across Pakistan, covering 30% of Pakistan’s population through more than a dozen functional fulfillment facilities. Bazaar is adding 3-4 new cities and towns to its last mile network every month, putting it on course to establish the country’s largest tech-enabled last mile footprint by the end of the year. Through this last mile network, Bazaar provides hundreds of top brands and manufacturers direct access to underserved merchants and geographies across retail categories powered by real time analytics and intel on brand performance significantly improving their distribution capability.

Easy Khata, Bazaar’s merchant software product, has brought a new dimension to B2B e-commerce in emerging markets. Easy Khata serves as the core system of record for merchants, helping them digitize procurement, inventory management, customer engagement, accounting, and lending. The app has on boarded over 2.4 million businesses across 500 cities and towns in the country, recording over $10B in annualized bookkeeping transaction value.

Bazaar Credit, the recently launched short-term working capital financing product, provides much-needed liquidity to its largely unbanked merchant base. To date, Bazaar has provided thousands of digital loans, with 100% repayment and significant uplift in merchant buying volumes. Bazaar’s proprietary credit model incorporates customer data from both its marketplace and merchant software products, giving it a differentiated ability to lend to this underserved segment.

“We believe that Pakistan is at an inflection point in its tech ecosystem development. Bazaar is tapping into the massive merchant opportunity and is leading the charge in the country. We are excited to back their incredible team and phenomenal growth in such a short span of time.” said John Curtius, partner at Tiger Global Management.

Bazaar was founded in June 2020 by Hamza Jawaid and Saad Jangda, two high school best friends who moved back to Pakistan with a mission to create an incredible institution for and from Pakistan. Their strong focus on team, culture, and product has helped them attract talent from some of the best companies and investors around the world, creating a unique and unprecedented talent flywheel in the country. Prior to Bazaar, Hamza was a management consultant at McKinsey & Company, while Saad was a product manager for ride-hailing and food delivery at Careem and for ad products at Snapchat.

“We are humbled and excited to continue on the path to create a generation defining story for Pakistan. With significant backing of two of the largest venture growth funds in the world, we believe this will continue to change the narrative on the country and inspire countless more and bigger stories in near future. This is a result of the trust and partnership of our colleagues, suppliers and most importantly our customers – the small merchants who are the backbone of our economy.” said the founders, Hamza and Saad.

With the fresh round of funding, Bazaar plans to expand into more cities across Pakistan, launch new marketplace categories, scale its lending offerings, and accelerate new product development.