-

Women Leading the Way in the UK Material Handling Industry - 2 days ago

-

DATA ANALYSIS – THE FOUNDATION OF EVERY PEAK SEASON - December 5, 2025

-

Creative education specialists Creative Hut give 3PL full marks for onboarding excellence - December 5, 2025

-

Unlimited Industries raises $12M to build the AI construction company that will power America’s future - December 4, 2025

-

Etaily lands strategic investment from Japan’s SMBC – bringing total funding to $24M for Social Commerce enablement platform - December 4, 2025

-

Prism eLogistics and Brand Angels Partnership Gives Brands the Full Package - December 3, 2025

-

New data shows Tesla in danger of losing its way as European consideration to buy Chinese cars jumps 16% in 12 months - December 3, 2025

-

QUECLINK DEVELOPS SATELLITE-ENABLED VEHICLE TRACKING FOR UNINTERRUPTED TRANSPORT MANAGEMENT - December 3, 2025

-

Ocado Ads partners with Epsilon for people-based precision - December 3, 2025

-

Combilift Unveils the 2025 Christmas video “Twelve Days of Christmas” – with a Twist! - December 1, 2025

LightMetrics scales globally having improved fleet driver behaviors with intelligent video as it secures $8.5m funding round.

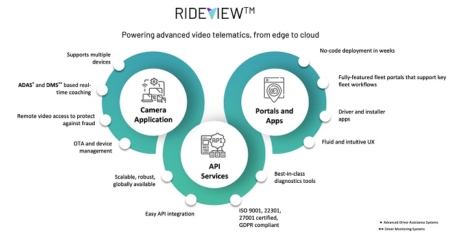

LightMetrics is powering the global vehicle telematics industry with intelligent video capabilities as revenues grow 3x while customer numbers cross 2,500 fleets globally. Their flagship no-code video telematics platform RideView is helping telematics service providers easily integrate video and improve road safety.

Commercial fleet owners are investing heavily in telematics data to improve road safety concerns, driver well-being and operational efficiencies. It’s a marketplace worth $76B today and set to grow to $214B in the next 6 years. However, their insurance claims have been steadily increasing over the past 5 years. Aiming to rebalance this equation, video telematics business LightMetrics is today announcing a $8.5m funding round from Sequoia Capital India, to help telematics service providers adopt video telematics and help fleets become safer.

LightMetrics helps telematics service providers (TSPs) by launching their own branded edge AI powered video telematics solution. Its flagship no-code video telematics platform RideView is widely considered the most impactful in the industry. It allows fleets to gain visibility into risky behaviors like distracted driving, tailgating, cell phone usage, overspeeding, stop sign violation, poor lane keeping and fatigue among several others. Intuitive workflows to retrieve videos, recognize good drivers and coach drivers helps fleet managers protect the fleet, improve driver engagement and reduce accidents.

With fleets in different verticals and geographies having different needs, RideView offers a choice of dash cameras across price points and capabilities, all supported by the same backend thus creating an uniform user experience no matter the dash camera hardware used.

Founded in 2015 by Nokia alumni Soumik Ukil, Ravi Shenoy, Mithun Uliyar, Gururaj Putraya, Pushkar Patwardhan and Krishna A.G, they came together to help make roads safer for everyone.They put their expertise to work in building efficient algorithms for computer vision technology, machine learning and AI by helping people “see how they drive” and coaching drivers to become safer.

In 2022, LightMetrics expanded into new geographies and grew revenues 3x. Their technology is now deployed in over 2500 fleets across US, Canada, Mexico, Brazil, Australia, South Africa, Middle East and India. LightMetrics’ video telematics platform RideView’s success and popularity with telematics service providers can be attributed to the significant outcomes they have achieved for customers, including a drop in risky driving behaviors such as speeding and distracted driving by up to 80% and 70% respectively within just a few months of installation.

Soumik Ukil, co-founder and CEO of LightMetrics commented: “Our growth and success comes down to the product – having built the preeminent video-based fleet safety platform globally. We will continue to invest deeply in building the most advanced and efficient edge AI, empowering our customer base to deliver this critical technology across the entire fleet ecosystem, and expanding our international footprint.”

The video telematics market is forecast to grow from 10% in 2021 to 20% by 2026, at an impressive growth rate of 16.5% CAGR. “Two key factors are driving the growth of this market; a combination of market need and the technology trends coming together. Fleet owners are seeking a single integrated view of all their data to improve safety and operations. Conventionally, while telematics has focused on location tracking, routing, optimal utilization of assets, vehicle maintenance, remote diagnostics, etc., it is clear that the performance of the human driver is critical to running a profitable fleet. Advanced video telematics, enabled by the advances in connectivity, chipsets (computing on the edge) and AI, is the comprehensive solution” said Soumik Ukil.

“Our approach, and the adoption of RideView, has created a win-win situation for everyone concerned. Fleets, the end user, benefit from improved safety, better driver engagement and lower insurance premiums. Our customers, the telematics service providers, are able to offer a holistic service to fleet owners with more comprehensive data and analytics around safety.”

Ashish Agrawal, MD, Sequoia India commented: “Video telematics is the fastest growing segment of the telematics industry. LightMetrics’ ability to deploy advanced computer vision models on the edge, across a range of dash cameras, enables it to serve all vehicle types in this large market. At Sequoia Capital India, we expect advancements in AI to transform several industries and are excited to partner with LightMetrics on their quest to improve road safety.”

“Investing in technology can also drive down insurance premiums for fleet owners. A granular understanding of driver behavior can help underwriting with better risk modeling, and ongoing driver coaching helps insurance carriers reduce loss over time. I am confident that video telematics can help insurance carriers significantly on claims, underwriting and loss control.” said Soumik Ukil.