-

Nutrivend selects Forterro’s Orderwise to support online expansion and streamline operations - April 11, 2025

-

ARROWXL LAUNCHES AMBITIOUS ZERO WASTE ROADMAP - April 8, 2025

-

THE BCMPA’S NEW CAMPAIGN DRIVES OUTSOURCING SUCCESS IN Q1 - April 7, 2025

-

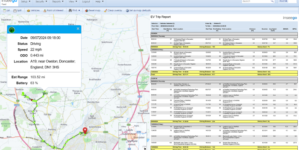

BLACKOUT TECHNOLOGIES TARGETS TELEMATICS-INTEGRATED MOBILE DEVICE BLOCKING TO COMBAT SMARTPHONE DISTRACTION - April 1, 2025

-

Sparck Technologies awarded Royal designation - March 27, 2025

-

OpenADR Alliance announces first OpenADR 3.0 certified products with EVoke Systems, E.ON Energy and Universal Devices - March 25, 2025

-

Growing fulfilment and contract packer appoints new Managing Director - March 25, 2025

-

When is it time to invest in a WMS? Understanding the key trigger points - March 25, 2025

-

eCapital helps Vantage Recruitment on its journey to financial success - March 24, 2025

-

Hugo Beck Celebrates 70 Years of Packaging Innovation with Open House Events - March 20, 2025

Shippers Suspect Sulphur Stitch-Up.

The Global Shippers Forum has reacted with suspicion to the announcement by the Maersk container shipping line of new fuel surcharge arrangements from 1 January 2019 to recover presumed costs from the introduction of low-sulphur marine fuel from 1 January 2020.

Based on the information released by Maersk, the new charges, which are additional to agreed contract rates, are based on two factors – an average cost of fuel and a ‘trade factor’ that upscales the costs on head trades and discounts the fuel cost on reverse trades. But because the charge is per box, the greater number of revenue-earning boxes sailing west will collectively pay far more than they need to in order to compensate for the same boxes returning east when empty.

This has the effect of applying higher than average surcharges on their most profitable routes. For example, the Far East to North Europe route has a trade factor of 1.3, but North Europe to Far East of 0.7. In addition, Maersk has decided to help itself to a whole year of higher fuel surcharges, a full 12 months before the rules requiring them to use surcharges actually come in. And the new charging structure would apply to all variations of fuel price, not just due of the introduction of low sulphur fuel.

James Hookham, GSF Secretary General, said: “Asking customers to contribute to new environmental costs is to be expected, but this charge lacks transparency; no data is available to let customers work out how the charge has been calculated. Given historical experiences with surcharges, shippers are naturally suspicious over something shipping lines say is ‘fair, transparent and clear’. GSF will be taking this piece of financial engineering apart piece by piece as we suspect this has more to do with rate restoration than environmental conservation.

“Maersk has other options. Global rules allow lines to meet air quality standards by fitting ‘scrubbers’ to clean up exhaust emissions, rather than buying more expensive low-sulphur fuel. This requires a one-off capital expense, but for shippers this is a better option than paying sulphur surcharges indefinitely. Some of Maersk’s biggest competitors are taking this different approach, and customers will be looking at the options and voting with their wallets.

“What also disappoints shippers is the lack of negotiation about the timing and the structure of the charge. It would have been better if Maersk had discussed its plans with individual customers in the course of confidential contract reviews, rather than just publishing something that wouldn’t be out of place in the puzzles section of your daily newspaper.

“We suspect that other shipping lines will be tempted to follow suit, but it would surely be of concern to competition authorities around the world if the same formula were to be used by other shipping lines, especially in the same Alliance.

“GSF would encourage Maersk to consult with customers and reconsider their strategy. These new charges may be all about low-sulphur fuel, but they still stink to us!”