-

Nutrivend selects Forterro’s Orderwise to support online expansion and streamline operations - April 11, 2025

-

ARROWXL LAUNCHES AMBITIOUS ZERO WASTE ROADMAP - April 8, 2025

-

THE BCMPA’S NEW CAMPAIGN DRIVES OUTSOURCING SUCCESS IN Q1 - April 7, 2025

-

BLACKOUT TECHNOLOGIES TARGETS TELEMATICS-INTEGRATED MOBILE DEVICE BLOCKING TO COMBAT SMARTPHONE DISTRACTION - April 1, 2025

-

Sparck Technologies awarded Royal designation - March 27, 2025

-

OpenADR Alliance announces first OpenADR 3.0 certified products with EVoke Systems, E.ON Energy and Universal Devices - March 25, 2025

-

Growing fulfilment and contract packer appoints new Managing Director - March 25, 2025

-

When is it time to invest in a WMS? Understanding the key trigger points - March 25, 2025

-

eCapital helps Vantage Recruitment on its journey to financial success - March 24, 2025

-

Hugo Beck Celebrates 70 Years of Packaging Innovation with Open House Events - March 20, 2025

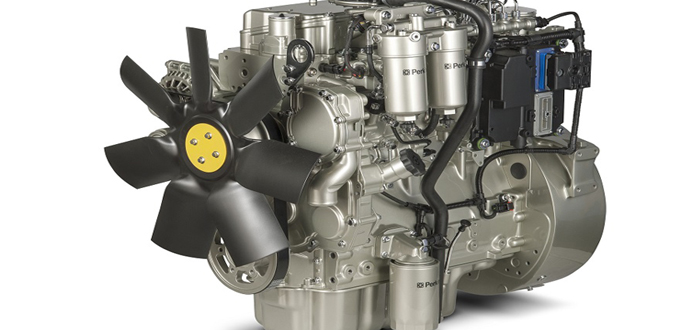

The diesel debate – the challenge for the construction equipment industry.

Faced with ever more-stringent environmental legislation, the construction equipment industry has retained its faith in the trusty diesel engine. And for good reason according to CEA consultant, Alex Woodrow.

As an independent consultant with over 20 years in the automotive and related industries there has never been a dull moment, with a constant ebb and flow of technology, mergers and acquisitions and other challenges to face. One of the constant factors over the 20 years, however, is the continuing pressure on OEMs in all the segments – light vehicle, commercial and non-road mobile machinery to reduce emissions and fuel consumption.

Working for stakeholders throughout the industry, focussed on powertrain and emissions related technologies, we’re very much in favour of an environmentally friendly automotive industry and related sectors, from powered two wheelers, passenger cars, light commercial vehicles, heavy commercial vehicles, buses, construction equipment, agricultural vehicles, and materials handling. In many of these segments all electric, or hybrid is practical, cost effective, and will lead to improved air quality. However, the future isn’t all electric, at least not yet and it’s not all internal combustion engine, each fuel has its place. For industrial segments, where the end-users are concentrated on productivity, ‘clean’ diesel should, and will, remain the dominant fuel for the foreseeable future.

It should be said as well that these diesels aren’t the diesels that emit black smoke and high levels of NOx, which is invisible, until it forms smog with other pollutants. They aren’t even the ‘clean’ diesels that were heavily promoted by a number of passenger car manufacturers, whose actions will have negative consequences for the broader industry for some time. These are cleaner diesels that produce considerably less than 10% of pre-regulated diesels noxious emissions, in machines that on average are at least 15% improved in terms of fuel efficiency, operating in an industry where optimising operating costs means the difference between making a profit, and staying in business, and losing money and disappearing. In essence, they are a productivity tool that makes a positive contribution at all levels of the economy.

So why do we stick with the view that diesel is the fuel for construction equipment, and what have the OEMs done to reduce their environmental impact?

1. R&D spend, even in the most severe recession was between 2 and 4% of revenues. Across the commercial vehicle and Non-Road mobile machinery segments this equated to around $10Bn per year, of which half on average has been spent on emissions and powertrain improvement, totalling $50Bn over the past 10 years. On top of that a similar amount has been spent on capital investment in plant.

2. Energy density of diesel is much higher than any other fuel, for the majority of equipment, electric would be impractical. Equally gasoline would be impractical, and unsafe in many job sites. Not only would equipment need refuelling a lot more frequently, increasing cost, reducing productivity, Direct injection gasolines would also require adoption of gasoline particulate filters to clean up the PM 2.5 particulates which a modern diesel tailpipe already has regulated through its particulate filter that will come as standard with Stage V. For a typical shift, an all-electric mid-range excavator would need a battery at least five times as big as a typical Tesla S model, costing over $100,000.

On a practical level, it also doesn’t make sense to compare light vehicle and industrial vehicles in the same way for a number of reasons:

• In the light vehicle segment the Top 20 manufacturing groups account for 90% of the global 92m units produced in 2016, on average 4.6m each. A further 30 accounted for the remaining 10m units, or 330,000 each. In comparison in the CV segment the Top 20 accounted for 82% of the 3.1m units, another 66 accounted for the remainder, 128,000 and 8,000 each respectively. However, in the construction segment an estimated 628,000 units where shared across the top 20, or 31,000 each, and another 100 plus accounted for the remaining 134,000 or just 1,300 units each.

• Many of them don’t have their own engines, of the top 10 OEMs the majority have their own engines, but in the Top 20 les than 40% are supplied by in-house, for various reasons.

• Product variety is several orders of magnitude greater. It is not due to competition that the volumes are so low, just that many machines are specialist machines.

So, to some extent it’s that volume equation that made it easier for passenger OEMs to ‘game’ the rules. If we do one, we might as well do them all. In the non-road segment where there is a much greater cross over of engines between OEMs it would be a lot harder to cheat the system.

Hybrids and alternative fuels will come, but in low volume initially. The above doesn’t preclude development of electric and hybrid. However, our own detailed assessment of the equipment population, considering load factors, fuel consumption and annual hours suggests that in Europe the below 56kW segment uses around than 15% of the total fuel but accounts for almost 40% of the machine population. Already much of this segment is looking to hybrid and electric so economies of scale are improving, and technology has aided here. However, in the larger machines, over 56kW this is not the case. As machines have become more expensive, mainly due to emissions control, so the rental segment has grown. Across the top machine types in Europe rental is estimated to have a greater than 70% share.

In the lightest segment, where emissions are not regulated until Stage V we expect to see a lot more electric models. In many cases where these are used indoors it makes sense. With either an umbilical or a power unit the power requirements mean that the infrastructure for charging is not extensive. As we get into the higher power segments however the power requirements increase significantly. In the light segment, there is also a cross-over between light vehicle systems and non-road electric and hybrid systems, which will allow more cost-effective electrification. In the heavier segments, the volumes will be much lower, and so there will be limited opportunities. Even in the lighter segments there are challenges in the non-road segment for electrification related to the conditions that the equipment works in, compared to the light vehicle segment, such as dust, vibration, temperature etc.

So, what else can be done?

• Machines have become cleaner in terms of absolute emissions limits and will improve further under Stage V

• Efficiency has improved, so that total kWH has fallen, further reducing emissions, and these competitive trends will continue

• Technology continues to improve, as OEMs get through emissions compliance there will be a focus on Total Cost of Ownership.

• Operators are becoming smarter, job sites are better designed, corporate sustainability is driving end users to specify cleaner machines

• Low emissions zones, and public procurement is driving end users towards cleaner machines

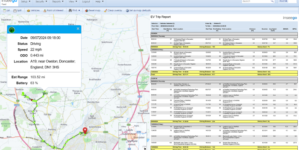

• A well maintained and serviced machine is a more productive machine, telematics shows when machines aren’t working to their optimum level, and will also indicate tampering or lack of compliance

• OEMs and their dealers are more actively working with their customers to specify and supply the right machine for the right job, not over specifying a machine

If technology trends follow the CV segment then there will continue to be improvements through the Stage V time period. Many OEMs that didn’t have a DPF for Stage IV, but remain within the limits, will be able to benefit from the trade-off between fuel consumption, NOX generation and PM levels, to use higher levels of EGR and reduce emissions further. At the same time, we expect the initial PEMs tests to show that machines are clean across the whole duty cycle, and offer similar compliance levels to those Euro VI trucks, which will continue to show improvements in emissions and fuel consumption. Those Euro VI trucks that were tested, were the first generation. 2nd and 3rd generation truck have added additional fuel consumption benefits whilst meeting stricter compliance requirements under Euro VI part B and C, and we expect a similar pattern in the Construction Equipment segment.